September 6 is the day when shares of Vodafone Idea had declined over 11% after brokerage firm Goldman Sachs had maintained its “sell” rating on the telecom service provider and projected a price target of ₹2.5 on the stock.

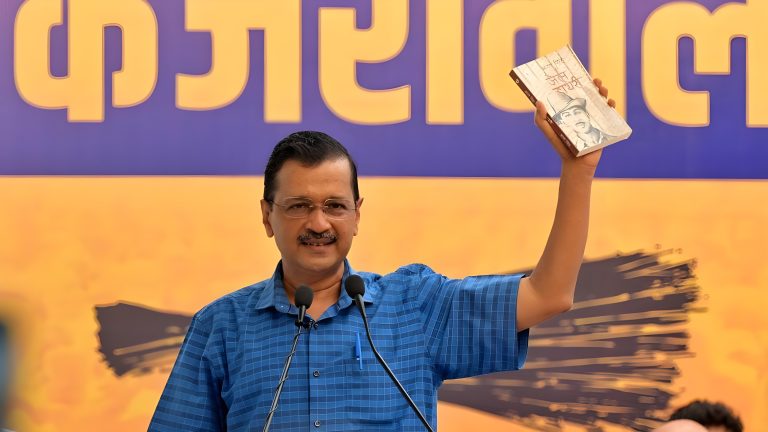

Vodafone Idea Ltd.’s shares fell for the third out of the last four trading sessions. The stock did not see any respite from selling after a brief pause on Tuesday, even after news of Aditya Birla Group chief Kumar Mangalam Birla buying shares in the company.

Official documents show that Kumar Mangalam Birla acquired 1.86 crore shares of Vodafone Idea on September 6, while Pilani Investment bought 30 lakh shares on the same date.

September 6 is also the day when shares of Vodafone Idea had declined over 11% after brokerage firm Goldman Sachs had maintained its “sell” rating on the telecom service provider and projected a price target of ₹2.5 on the stock, which had implied a potential downside of 80% from those levels.

The foreign brokerage projected an additional 300 basis points decline in Vodafone Idea’s market share over the next 3-4 years. Additionally, the company has significant adjusted gross revenue (AGR) and spectrum-related payments, which are expected to begin in financial year 2026.

This acquisition of stake by Kumar Mangalam Birla can also be termed as a “Creeping Acquisition.”

A Creeping Acquisition generally means when someone gradually continues to increase his / her stake in the company over a period of time.

In financial year 2021, market regulator Securities and Exchange Board of India (SEBI) had raised the creeping acquisition limit to 10% from 5% earlier. This relaxation though, was only applicable to preferential allotment of equity shares and did not apply to transfers, block or bulk deals.

Takeover regulations would be applicable if the promoter group crosses the Creeping Acquisition limit of 5% in a financial year.

As of July 19, promoters of Vodafone Idea had a 37.17% stake in the company, while Pilani Investments did not have any prior stake.